PETTY CASH AND IMPREST SYSEM ( COLUMNAL PETTY CASH BOOK)

Petty Cash and Imprest System (Columnal Petty Cash Book)

Operation of the Petty Cash Book

Determine the operation of the petty cash Book

Petty Cash Book:

Petty cash book is a kind of cash book which records large number of small payments such as conveyance, cartage, postage, telegrams and other expenses under the imprest system. These expenses are repetitive in nature. The procedure becomes cumbersome if all small and repetitive payments are handled by the main cashier and are recorded in the main cash book.

The cash book may become very bulky and the cashier may be overburdened. Applying the rule of ‘management by exception’ the main cashier should not be disturbed for small and petty items.

Big organizations normally appoint one or more cashier known as ‘Petty Cashier’ and assign the handling of petty expenses. Sometimes the work of handling small and petty expenses is assigned to an existing employee who in addition to his normal duties maintains a separate cash book to record these petty and small cash transactions. For this purpose petty cash book is to be maintained by such employee. The petty cashier so appointed for recording the small and petty expenses works on the imprest system.

Difference between Cash Overage and Shortage

Distinguish between cash overage and shortage

Situation in which the physical amount of cash on hand differs from the book recorded amount of cash. When a business is involved with over-the-counter cash receipts, occasional errors may occur in making change. The cash shortage or overage is revealed when the physical cash count at the end of the day does not agree with the cash register tape. Assuming that the count is Sh.60000 and the cash register reading shows Sh.62000, the cash shortage and overage account would be charged for 2000. It is shown in the income statement.

Meaning and Implication of the Imprest System and Petty Cash Vouchers

Explain the meaning and application of the imprest system and petty cash vouchers

Imprest System:

Under the impress system, a fixed amount say Rs. 5,000 is given to the petty cashier for incurring small and petty expenses. This amount is called imprest money. The petty cashier makes all the payments for which he is authorized out of the imprest amount. After a specific period or as soon as he exhausts the full imprest amount, whichever is earlier, he gets reimbursement for the actual amount spent by him from the main cashier.

Thus at the beginning of the next period he once again has the full imprest amount. Keeping in view the quantum of amount involved and frequency of transactions, reimbursement of amount is made on a weekly, fortnightly, monthly basis. Sometimes the petty cash system is operated through the main cash book and in that case petty cash book is not maintained independently.

Advantages:

- Reduces the labour: Petty cash book is based on the division of labour and works on imprest system; hence, it reduces the work and labour of main cashier.

- Controls irregular expenses: One of the famous principles of management is ‘control by exception’ which means that if one person tries to control everything, he may end up controlling nothing. Based on this principle, a petty cashier is appointed who can control the irregular expenses. In the absence of petty cashier, it is very difficult to watch and control the necessities of incurring any expenses.

- Main cash book does not become over bulky: Petty cash book helps to keep the main cash book in a compact form because numerous entries for small and petty items are recorded in the petty cash book itself.

- Quick payment possible: In petty cash book, payments for petty items are recorded. Though they are small, yet they are essential. Sometimes they are so urgent that they cannot wait for approval of the higher authority. In that case quick payment is required and this can be made by the petty cashier.

Sorting out Different Petty Expenditures and the Technique of Recording them in the Petty Cash Book and Journals

Sort out different petty expenditures and the technique of recording them in the petty cash book and journals

Types of Petty Cash Books:

There are the two methods of preparing petty cash book:

- Simple Petty Cash Book

- Analytical Petty Cash Book or Columnar Petty Cash Book

I. Simple Petty Cash Book:

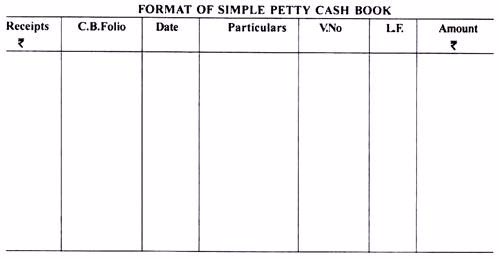

In simple petty cash book there is one column each for recording of receipt of cash from the main cashier and for payment of petty expenses. ‘Date’ and ‘Particulars’ column is same for receipts and payments. In the ‘C.B. Folio’ column, page number of cash book in which payment to petty cashier is made is to be recorded.

In the particular column heads of the items are to be mentioned. In ‘V .No’ column, voucher number of the transactions are recorded. ‘L.F.’ column shows where the posting of these items have been made in respective ledgers. ‘Amount’ column shows the money value of the transactions.

The format of simple petty cash book is as under:

II. Analytical Petty Cash Book:

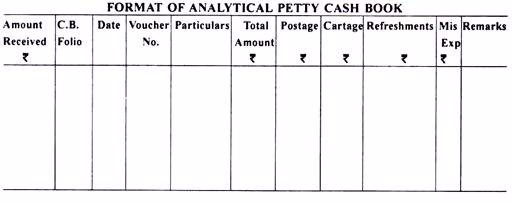

Analytical Petty Cash Book or Columnar Petty Cash Book is different from the simple petty cash book in the sense that in this type of petty cash book, an analytical presentation of cash payment is made. All petty payments are to be classified into different heads and different columns are maintained.

The format of the analytical petty cash book is as under:

Explanations to the Various Columns & Balancing the Analytical Petty Cash Book:

Receipts are recorded in one amount column on the receipts (debit) side known as ‘Amount Received’ column. However, for recording receipts and payments the column for date, voucher number and particulars are common. For recording petty expenses, petty cash book has one column on the payment (credit) side which is known as ‘Total Amount’ column.

In this column total of various expenses paid by same voucher and on the same day are recorded at one place. The total amount column is followed by number of columns for recording the heads of items which are most common in the business enterprise.

After allotting the columns to most common heads, one column is allotted for recording miscellaneous items which are known as “Miscellaneous’ column. Payments for which a separate column does not exist are recorded in this column.

The last column is allotted for ‘Remarks’. The nature of payments is recorded in this column. All amount columns are totaled at the end of the period. The total amount spent and the amount reimbursed shall be shown in the total amount column.

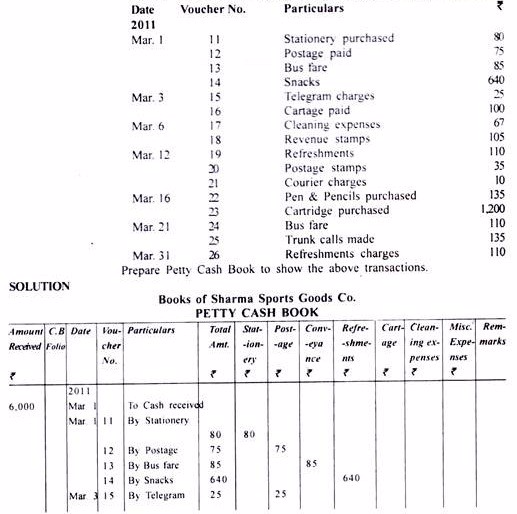

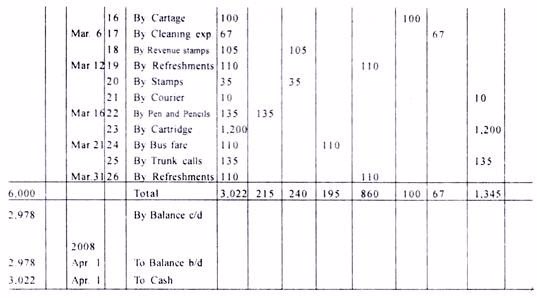

Illustration 3: (Petty Cash Book)

Sharma Sports Goods Co. follows the imprest system of petty cash under which, Rs 6,000 was handed over to the petty cashier as on 1st March 2011.The expenses during the month were as follows:

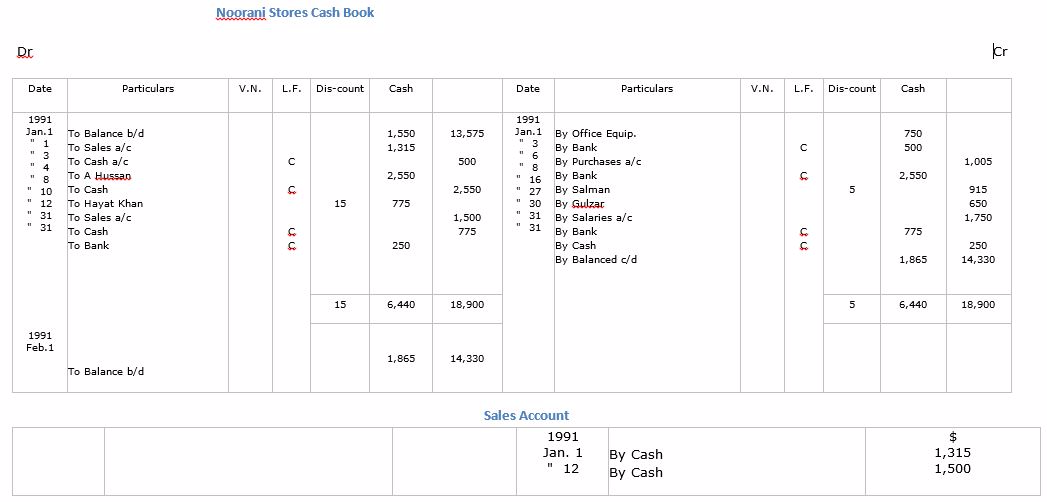

Format of the Three Column Cash Book:

Example of Three Column Cash Book:

| 1991 | |

| Jan.1 | Purchased office typewriter for cash $750; cash sales $315 |

| " | Deposited cash $500 |

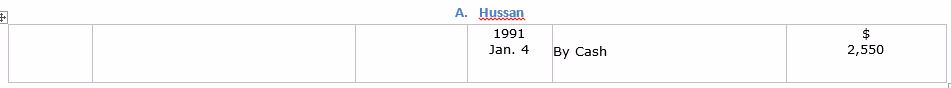

| " 4 | Received from A. Hussan a cheque for $2,550 in part payment of his account |

| " 6 | Paid by cheque for merchandise purchased worth $1,005 |

| " 8 | Deposited into bank the cheque received from A. Hussan. |

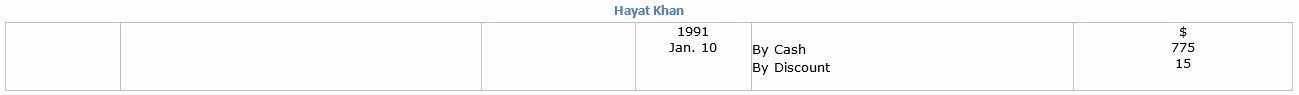

| " 10 | Received from Hayat Khan a cheque for $775 in full settlement of his account and allowed him discount $15. |

| " 12 | Sold merchandise to Divan Bros. for $1,500 who paid by cheque which was deposited in the bank. |

| " 16 | Paid Salman $915 by cheque, discount received $5 |

| " 27 | Paid to Gulzar Ahmad by cheque $650 |

| " 30 | Paid salaries by cheque $1,750 |

| " 31 | Deposited into bank the cheque of Hayat Khan. |

| " 31 | Drew from bank for office use $250. |

You are required to enter the above transactions in three column cash book and balance it.

Solution:

<!-- [if !supportLists]-->A. <!--[endif]-->Hussan

Hayat Khan

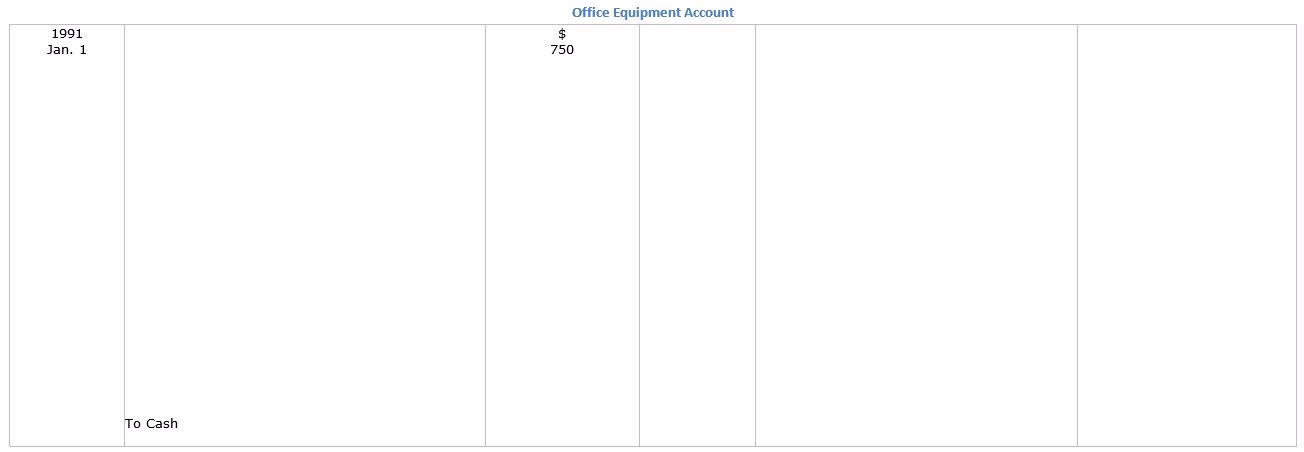

Office Equipment Account

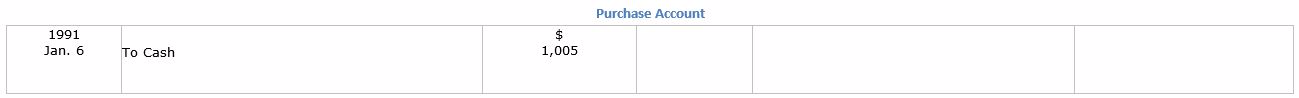

Purchase Account

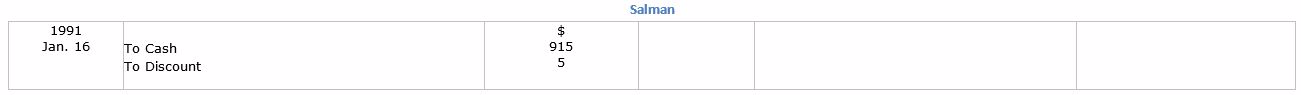

Salman

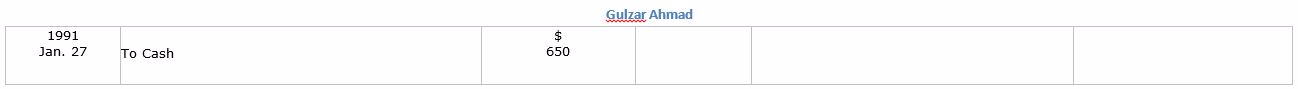

Gulzar Ahmad

Salaries Account

Discount Account

Journal Entries

Journal entries are the first step in the accounting cycle and are used to record all business transactions and events in the accounting system. As business events occur throughout the accounting period, journal entries are recorded in the general journal to show how the event changed in the accounting equation. For example, when the company spends cash to purchase a new vehicle, the cash account is decreased or credited and the vehicle account is increased or debited.

Identify Transactions

There are generally three steps to making a journal entry. First, the business transaction has to be identified. Obviously, if you don't know a transaction occurred, you can't record one. Using our vehicle example above, you must identify what transaction took place. In this case, the company purchased a vehicle. This means a new asset must be added to the accounting equation.

Analyze Transactions

After an event is identified to have an economic impact on the accounting equation, the business event must be analyzed to see how the transaction changed the accounting equation. When the company purchased the vehicle, it spent cash and received a vehicle. Both of these accounts are asset accounts, so the overall accounting equation didn't change. Total assets increased and decreased by the same amount, but an economic transaction still took place because the cash was essentially transferred into a vehicle.

Journalizing Transactions

After the business event is identified and analyzed, it can be recorded. Journal entries use debits and credits to record the changes of the accounting equation in the general journal. Traditional journal entry format dictates that debited accounts are listed before credited accounts. Each journal entry is also accompanied by the transaction date, title, and description of the event. Here is an example of how the vehicle purchase would be recorded.

Since there are so many different types of business transactions, accountants usually categorize them and record them in separate journal to help keep track of business events. For instance, cash was used to purchase this vehicle, so this transaction would most likely be recorded in the cash disbursements journal. There are numerous other journals like the sales journal, purchases journal, and accounts receivable journal.

Example

We are following Paul around for the first year as he starts his guitar store called Paul's Guitar Shop, Inc. Here are the events that take place.

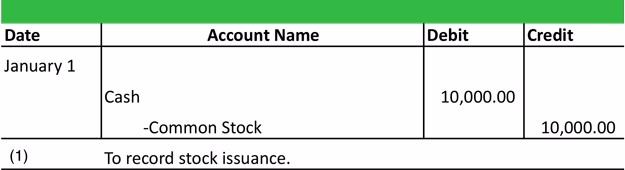

Journal Entry 1 -- Paul forms the corporation by purchasing 10,000 shares of $1 par stock.

Journal Entry 2 -- Paul finds a nice retail storefront in the local mall and signs a lease for $500 a month.

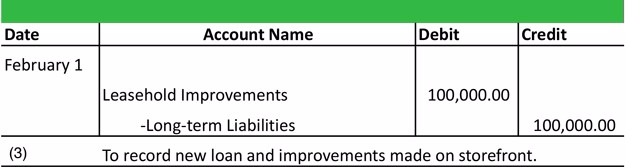

Journal Entry 3 -- PGS takes out a bank loan to renovate the new store location for $100,000 and agrees to pay $1,000 a month. He spends all of the money on improving and updating the store's fixtures and looks.

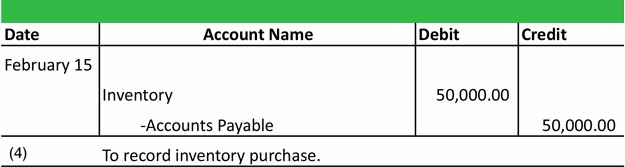

Journal Entry 4 -- PGS purchases $50,000 worth of inventory to sell to customers on account with its vendors. He agrees to pay $1,000 a month.

Journal Entry 5 -- PGS's first rent payment is due.

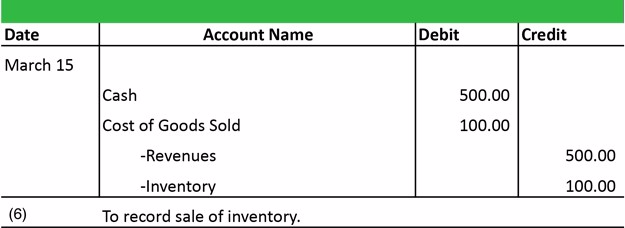

Journal Entry 6 -- PGS has a grand opening and makes it first sale. It sells a guitar for $500 that cost $100.

Journal Entry 7 -- PGS sells another guitar to a customer on account for $300. The cost of this guitar was $100.

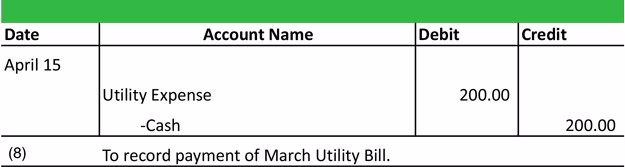

Journal Entry 8 -- PGS pays electric bill for $200.

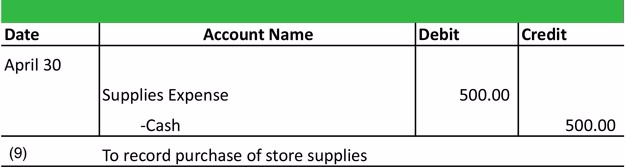

Journal Entry 9 -- PGS purchases supplies to use around the store.

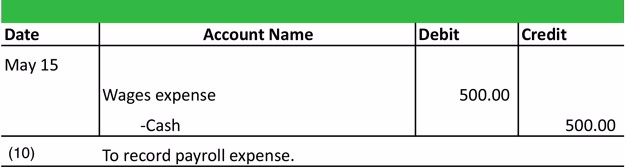

Journal Entry 10 -- Paul is getting so busy that he decides to hire an employee for $500 a week. Pay makes his first payroll payment.

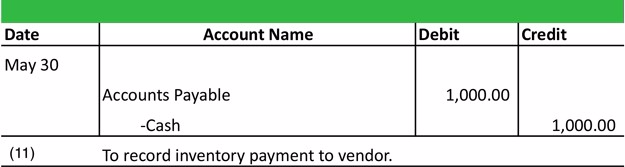

Journal Entry 11 -- PGS's first vendor inventory payment is due of $1,000.

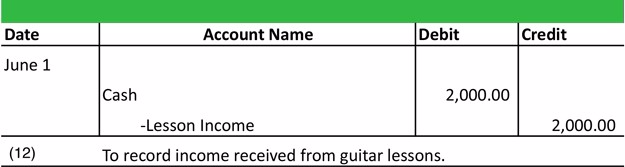

Journal Entry 12 -- Paul starts giving guitar lessons and receives $2,000 in lesson income.

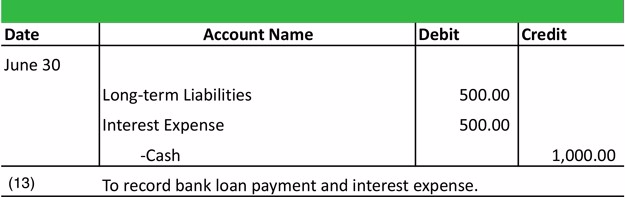

Journal Entry 13 -- PGS's first bank loan payment is due.

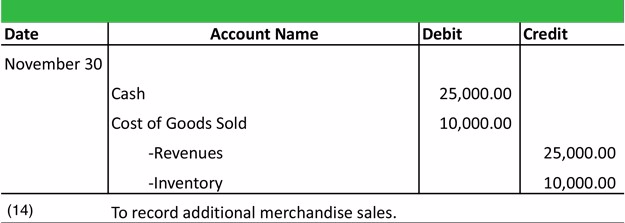

Journal Entry 14 -- PGS has more cash sales of $25,000 with cost of goods of $10,000.

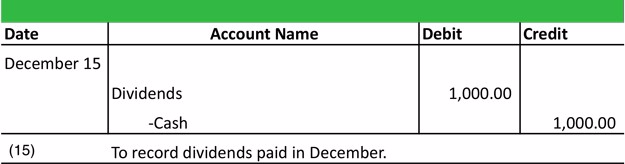

Journal Entry 15 -- In lieu of paying himself, Paul decides to declare a $1,000 dividend for the year.

Now that these transactions are recorded in their journals, they must be posted to the T-accounts or ledger accounts in the next step of the accounting cycle.

Exercise 1

Exercise: 1

What's the entries for the following: <!-- [if !supportLineBreakNewLine]--> <!--[endif]-->

- Business started with cash 8,000 and plant & machinery 3,000.

- Stock purchase for sale (cash purchase)= 3,000, credit purchase = 5,000

- Wages paid 120,000(including 20,000 of future year).

- Salary paid 200,000 but due 110,000.

- Sale made for cash 600,000 & on credit 800,000.

- Depreciation 10 percent on plant & machinery.

- Goods costing 20,000 destroyed by fire.

- Payment made to creditor of 200,000 at 10 percent discount.

Exercise 2

Exercise 2.

Enter The Following Transactions In Cash Book With Cash And Bank Column Of Rao & Sons.

JUNE 2010 Particulars <!-- [if !supportLineBreakNewLine]--> <!--[endif]-->

- 1 started business with cash Rs. 1,00,000

- 3 opened a bank current a/c with SBI Rs. 60,000

- 6 brought goods from ashok Rs. 15,000

- 8 paid ashok by cheque Rs. 14,700 and received discount Rs. 300

- 10 sold goods to mohan for cash Rs. 10,000 and on credit Rs. 22,000

- 12 received cheque from mohan 21,400 and allowed discount Rs. 600

- 13 cheque of mohan deposited into bank

- 15 paid electricity charges Rs. 1100 & rent Rs. 2,000

- 17 received a cheque from total for Rs. 6,800 in full settlement of his a/c Rs. 7,000

- 19 endorsed the cheque of gopal in favour of our creditor amar

- 23 withdrew cash from bank for office use Rs. 5,000 & for personal use 3,500

- 25 bought a machine from raman. He was paid by cheque 9,000

- 26 paid carriage of machine Rs. 300 and installation charges Rs. 700

- 29 bank allowed interest Rs. 800 & bank charges were Rs. 200

- READ TOPIC 3: Bank Reconciliation Statement

No comments:

Post a Comment